One of the questions most asked around the World Wide Web revolves around, Does Venmo work internationally? Well, there are good news and bad news. The good news is, if you are a resident of the United States, Canada, United Kingdom, Australia or any European Union country, then you probably won’t find yourself receiving SMS transfers from any third party outside of your country. In other words, you can rest assured that if someone sent you a transaction request from another location, you will not receive it, unless the sending party is based in one of these countries. The bad news is, if you are not located in one of these countries, then chances are, you will not receive anything at all.

So, what can you do if you are looking to use Venmo to transfer money internationally? This is a common question among many US citizens who are still living in other countries. The good news is, that there are services that do allow you to send and receive transactions made within the country you are currently residing in. These third party companies have developed apps for mobile devices which allow you to send and receive SMS from any location, anytime. So, what can you do when you want to send a transaction request to one of your friends across the globe?

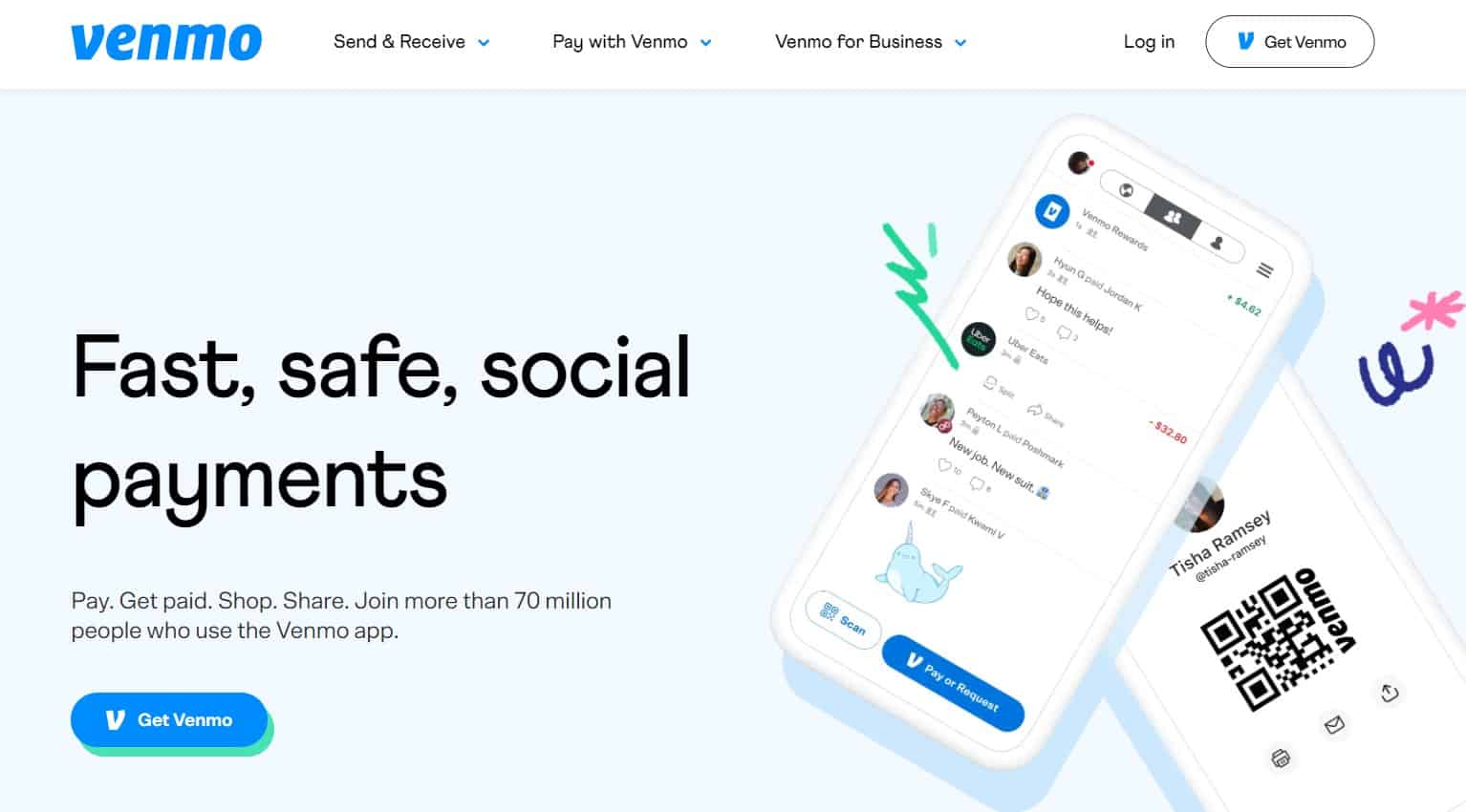

The good news is, that this application does work internationally. Unlike services like PayPal, Google Checkout and Facebook Money Transfer, using this service does not require you to have an EFT account. So if you are abroad and want to send money internationally, all you would have to do is open the app, login and place a money-load onto it.

You might be wondering how this money transfer service works internationally. The way this works is through the use of a specialized Venmo voucher code deposit provider. All you would have to do is place your request and wait for your friend’s cell phone to ring with the cash you have requested him to send. As soon as your friend to receive the cash request, he can give you back his voucher code via his mobile phone. This is the instant-pay option that works internationally, allowing you to use your credit card even while you are abroad.

What this means is, that any time you come across an offer where you can get cash back, whether it is for gas prices or for any other purchase, you can simply login to the website of the provider and place a request for a withdrawal of funds. However, instead of withdrawing your money from your bank or financial institution, you can simply go through the process of acquiring instant-pay for your purchases made using your credit card. This is because the instant-pay service providers are partnered with leading online retailers who often include voucher codes or coupon books in order to facilitate the process of spending money on goods and services offered by their sites. In effect, instead of visiting the site of the participating retailer, you can simply go through their websites where you can find vouchers and coupons. And voila!

So what can you do with this? There are two ways by which you can make use of instant international money transfers: using your credit card or using your debit card. Both methods usually involve sending money to your friend’s bank account or to your own bank account. But with a debit card, you can withdraw instant cash while you are abroad.

The second option is a little trickier. If you don’t want to go through the hassle of logging onto the online bank account of your friend or family member, then you can use PayPal to send money. To be able to use this type of payment mode, you need to open a PayPal account. Once your PayPal account is opened, you can now link it to your existing bank account. You can also use your debit card in order to send money to your friend’s bank account.

These are the two options that you have. If you want something easier and less hassle-free, then you should try out Google Wallet. With this type of Google wallet, all you need to do is to sign up with Google, add your bank account to your Google Wallet account and you’re done! There’s no need to sign up separately for each financial institution or bank – everything you need is already integrated in Google Wallet.