In the dynamic world of cryptocurrency trading, traders are constantly seeking effective strategies to capitalize on short-term price movements. One such strategy is the 1-minute scalping technique, which aims to make quick profits by opening and closing positions rapidly. This article will introduce you to the popular 1-minute scalping strategy using the 3-EMA (Exponential Moving Average) indicator.

Understanding the Best 3-EMA Trading Strategy:

The 3-EMA trading strategy combines simplicity and efficiency in identifying short-term market trends. EMA is a moving average that gives greater weightage to recent data points, making it more responsive to current price movements. By using the 3-period EMA on a 1-minute chart, traders can quickly identify potential entry and exit points.

Setting up the 3-EMA Trading Strategy:

Before implementing this strategy, ensure that you have access to a reliable and user-friendly cryptocurrency exchange platform like Binance, Coinbase, Kraken, Bybit, Bitstamp, KuCoin, OKX, Bitfinex, HTX or Gemini. Once you have platform access and a basic understanding of candlestick charts and indicators:

- Choose a currency pair: Select a high-volume cryptocurrency pair with tight spreads for optimal results.

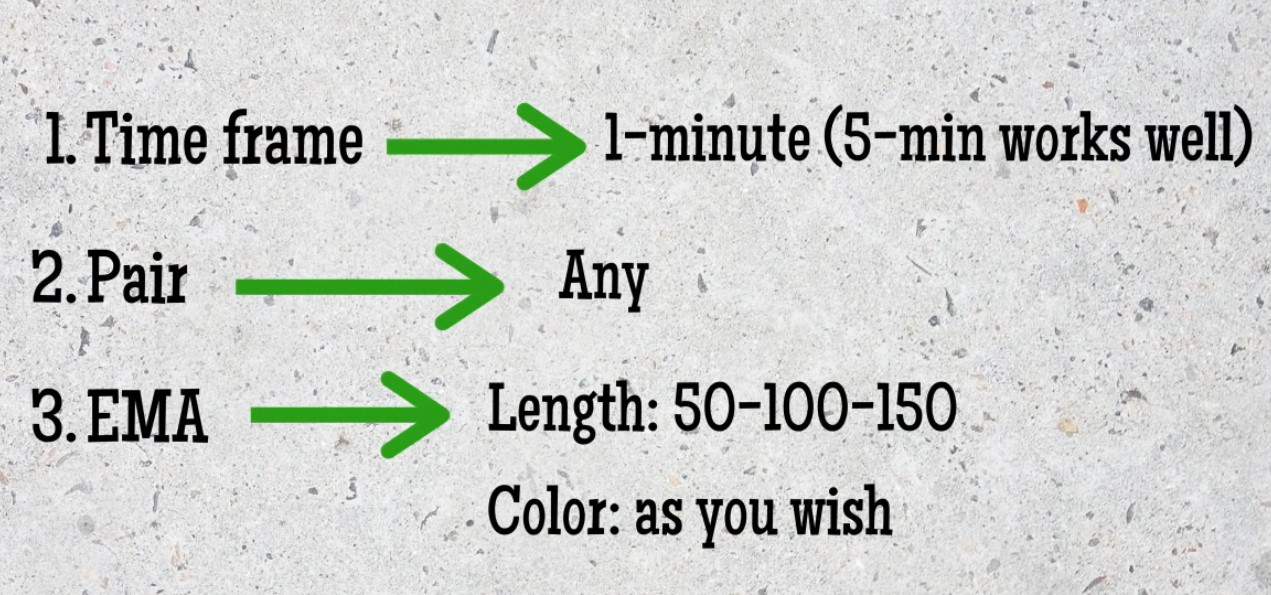

- Set up your charts: Use a 1-minute timeframe to monitor short-term price fluctuations.

- Apply indicators: Add the Exponential Moving Average (EMA) indicator with parameters set to “close” and period set to “3”.

- EMA Length: 50 , 100 , 150

Executing the Scalping Strategy:

Once your charts are set up correctly and you’ve identified a favorable currency pair:

- Determine trend direction: Observe whether the EMA line is sloping upwards (indicating an uptrend) or downwards (indicating a downtrend).

- Confirm entry point: Wait for the price to pull back slightly against the trend and retest the EMA line.

- Enter a position: Open a long (buy) position when the price breaks above the recent high after the pullback or open a short (sell) position when it breaks below the recent low.

- Set stop loss and take profit levels: Place tight stop-loss orders just outside of recent swing highs or lows, and set your take profit target based on your risk-reward ratio.

- Manage your trades: Monitor your positions closely, adjusting stop losses if necessary, and consider trailing stops to lock in profits as the market moves in your favor.

- Exit strategy: Close out your position when an opposing signal or price reversal occurs, or when you’ve reached your predetermined profit target.

Risk Management and Tips:

It is essential to maintain good risk management practices while employing any trading strategy:

- Set realistic profit targets: Avoid being greedy and establish achievable profit goals for each trade.

- Use proper leverage: Exercise caution when using leverage, ensuring it aligns with your risk tolerance.

- Limit exposure per trade: Allocate a small percentage of your overall portfolio to each individual trade to mitigate risks.

- Practice patience and discipline: Stick to your trading plan, avoid impulsive decisions, and don’t chase trades that do not meet the specific criteria of this strategy.

Conclusion:

The 1-minute scalping strategy using the 3-EMA indicator provides traders with a simple yet effective approach to capitalize on short-term price movements in cryptocurrency markets. By identifying trends through EMA crossovers and making quick entries based on pullbacks, traders can exploit rapid market fluctuations for potential profits.

Remember that successful trading requires continuous practice, analysis, adaptability, and risk management. It is recommended to backtest this strategy on historical data or utilize paper trading before risking real capital.

Whether you are trading on Binance, Coinbase, Kraken, Bybit, Bitstamp, KuCoin, OKX, Bitfinex, HTX, Gemini or any other reputable exchange platform, the 1-minute scalping strategy can be implemented with ease. Consistent practice and implementation of sound trading principles will help you refine your skills and potentially enhance your trading success.