In today’s fast-paced world, every individual wants their insurance claims to be processed quickly and efficiently. But the insurance claiming process is lengthy as it includes investigation, multiple administrative tasks, remittance or denial of claims, etc. Particularly health care practitioners get hundreds of such claims daily, which need to be processed within a certain time frame to fulfill customers’ needs and ensure customer satisfaction. But as this process is time-consuming as well as needs a lot of resources, these healthcare practitioners need to look out for ways to deal with these challenges.

One strategy used is to outsource medical data entry and insurance claims processing services to experts who can help you cut costs and deliver results quickly. If you plan to do so, you will get complete knowledge about outsourcing insurance claim processing services here in this guide, so continue reading.

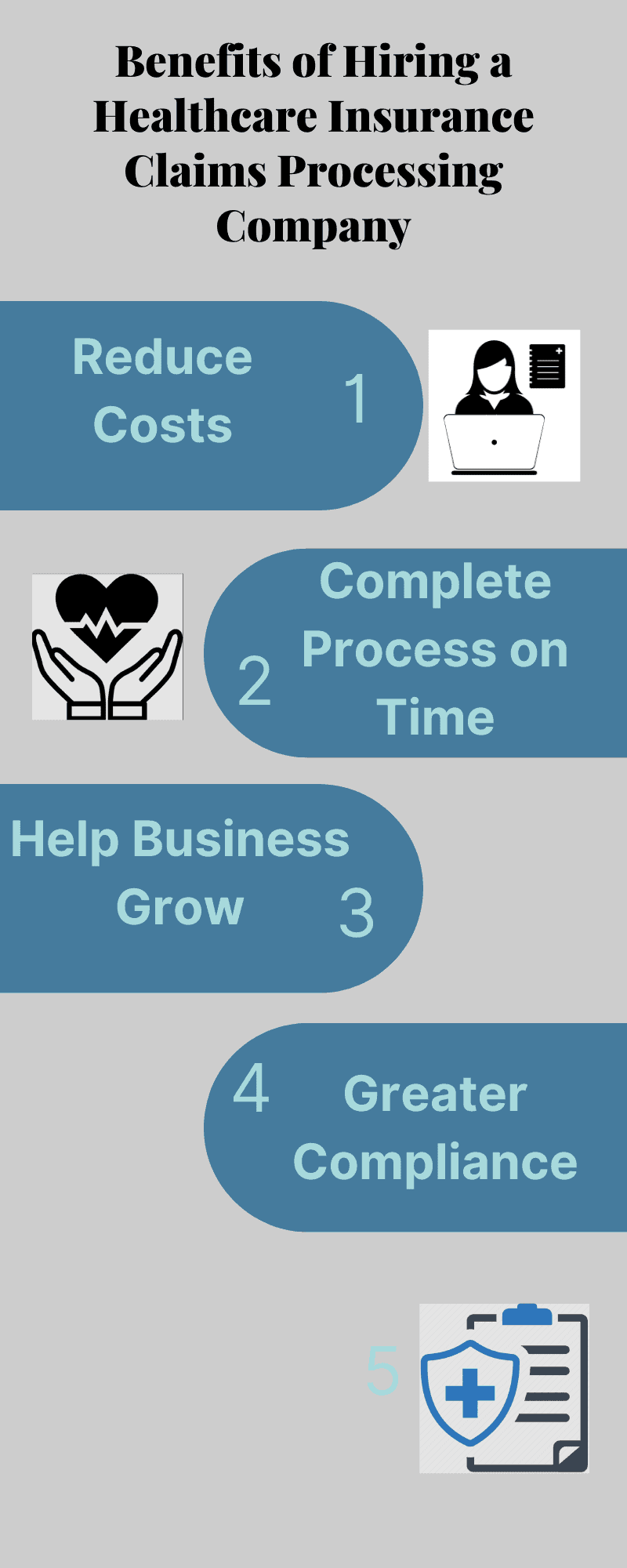

Benefits of Hiring a Healthcare Insurance Claims Processing Services Provider

Filing an insurance claim is mainly accomplished by adhering to pre-set arrangements. Having poor efficiency and erroneous handling of insurance claims could lead to rejection or denials. Hence it is advised to hire an insurance claim service provider as they have the following benefits:-

1- Reduce Costs

Processing claims necessitates significant infrastructure and workforce capacity investments. In addition, major catastrophes or global pandemics might produce unanticipated spikes in insurance claims, which can lead to unplanned recruiting drives and additional expenditures. Hence to save on such huge costs, practitioners can hire a third-party service provider at an affordable cost ensuring a high-quality and efficient insurance process.

2 – Completing Process on Time

To complete the insurance process faster, the claim should be filed with zero errors and 100% accuracy. Outsourcing healthcare insurance claims processing services help you fill the claim on time with minimal error and greater accuracy. These professionals have experience and thus understand the importance of timelines in insurance claim processes. Therefore, they ensure high process efficiency and ensure no delay or possibility of rejection.

3 – Help Business Grow

By counting on these service providers, your in-house team will have extra time and efficiency to take on more work and grow your business notably. Companies can focus on their main businesses by delegating the responsibility of insurance claim processing to professionals with years of experience in this industry. Brands will no longer need to invest in hiring or training employees and purchasing the required resources like tools and software. The time and money saved can be used in operations that support business expansion.

4 – Greater Compliance

As insurance policies are highly volatile in nature, healthcare institutions need to be flexible when they are required to use new techniques and make necessary adjustments to handle claims. But not every company can afford to make these sudden switches due to budget and time constraints. Outsourcing it to insurance claim processing services provider is a smart decision as they are well trained in carrying out smooth transitions whenever there is a need to adopt new changes. This way, your brand can maintain a high level of consistency and compliance in the process.

5 – Improve Customer Experience

Research has suggested that the success of an insurance company depends on the claim function. In this competitive world, customers expect fast services and tend to choose a company that is fast in processing claims. Hence, if you want to stay in long-term touch with your customer, you have to enhance the customer’s experience. Outsourcing partners can take care of customer experience while implementing the best strategy.

6 – Access to Insurance Technology

In this digitalized world where customers prefer buying insurance online, brands cannot avoid adopting this change. However, not every brand can afford it, as it calls for heavy investment in terms of purchasing tools and training the employees to meet the required demand. In such a case, third-party insurance claim vendors can help you digitally handle your complete insurance process. They have the required resources and experience to handle the process digitally. Furthermore, research has shown that digital claims functionality can reduce 25-30% of the claim expenses, which will benefit the client as well as the company.

7 – 24*7 Support Services

As you can not say when your customers are going to need medical insurance claim support, you should have a full-time assistance system for your customers. With an outsourcing partner, you can have a 24*7 claim handling team who can make it easier to monitor your customers’ needs and resolve all their queries when needed.

How to Hire a Medical Insurance Claim Processing Company?

A large number of outsourcing companies in the market are ready to provide insurance claim processing services to medical practitioners. However, you must focus your search and find a business that meets your needs and has a solid track record of providing high-quality services.

1 – Check the Past Experience

Choose a company that has been a part of this market for a long time rather than choosing a new player as an experienced company will already have a team of professionals who are capable of carrying out the task efficiently and with minimal errors.

2 – Go for a Well Reputed Company

A quick review search is not enough for you to find out whether a company is good or bad. Markets are crowded with all types of vendors, so be extra careful. Check the reviews of shortlisted insurance partners on different medical third-party sites that provide genuine reviews about these vendors.

3 – Check the Cost of Service

Cost is a crucial factor in every decision you make. The services you receive from an outsourcing company will rely on your budget. You run the danger of spending more than you planned if the price is too high. On the other hand, you run the danger of getting bad-quality service if it is too low. Hence, picking a business that charges fairly for its services and produces outcomes is crucial.

4 – Inquire About the Technology

Tools used by companies are one of the most important resources to provide high-quality results. Hence, before hiring any service provider, you should check the tools they use. If you have requirements for any particular tool, you can ask them whether they can arrange for it or not. It is crucial to inform the insurance company of this requirement in advance and have their confirmation.

5 – Ask Whether They Provide Assistance With Denial Management

You may easily manage denied claims by partnering with a medical insurance business with a strong denial management staff. Find out from the company how much assistance they can provide if your claim is rejected.

Conclusion

Insurance companies must ensure high customer satisfaction when completing the claim process. But amidst a lot of pressure to get all the work done, this crucial part might get hampered. Hence hiring an insurance claim processing company can help you create a totally unique customer service strategy based on your brand and business requirements. So keep the above-given tips in mind while hiring this service provider.