Life insurance is an important part of planning for your family’s future. The availability of several options can give you a variety of tailored options to pick from. Life insurance helps ensure your family has enough coverage to live comfortably in case you’re no longer around. This ensures they’re okay financially in case of unfortunate events.

Choosing a top life insurance plan is a key step in protecting them. Have you considered providing a safety net for your family? Let’s examine some factors we need to consider when choosing a suitable life insurance plan.

Assessing Your Needs

The first step is to evaluate your specific insurance requirements. Consider the following:

- Financial Dependents: Determine the number of people relying on your income.

- Outstanding Debts: Calculate the amount of loans and other liabilities.

- Future Financial Goals: Identify long-term financial objectives like children’s education or retirement.

- Risk Tolerance: Assess your comfort level with different types of insurance plans.

Once you have a clear understanding of your financial obligations and aspirations, you can determine the ideal coverage amount.

Understanding Different Life Insurance Plans

There are several types of life insurance plans to choose from. Each offers unique features and benefits:

- Term Insurance: Provides coverage for a specific term, offering affordable protection.

- Whole Life Insurance: Offers lifelong coverage with a savings component.

- Money-Back Plans: Offers periodic survival benefits along with a lump sum on maturity or death.

- Unit-Linked Insurance Plans (ULIPs): Combines insurance with investment options.

Consider your financial goals and risk appetite to select the life insurance plan that aligns with your needs.

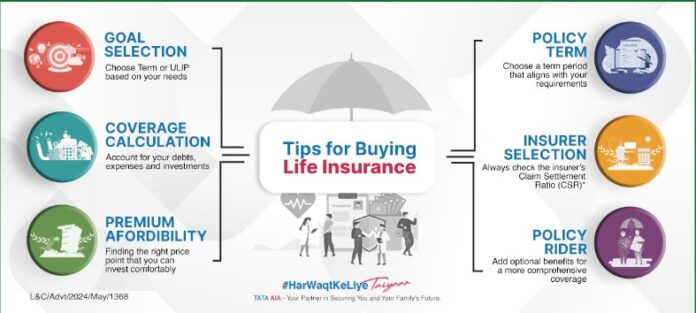

Key Factors to Consider

Selecting the right life insurance plan involves careful consideration of several factors. Here’s a breakdown:

Coverage Amount

Determining the appropriate sum assured is crucial. Evaluate your family’s financial obligations, including outstanding debts, future goals like children’s education or retirement, and their lifestyle. A comprehensive financial needs analysis can help you arrive at the optimal coverage amount.

Premium Affordability

While adequate coverage is essential, the premium should fit comfortably within your budget. Consider your income, expenses, and other financial commitments. Some insurers offer flexible premium payment options to suit different financial situations.

Claim Settlement Ratio

A high claim settlement ratio indicates an insurer’s efficiency in processing and approving claims. Research insurers with a strong track record of timely claim settlements. This reflects the company’s commitment to policyholders.

Riders

Riders are additional benefits that can enhance your life insurance coverage. Consider options like critical illness, accident, or disability riders to provide comprehensive protection for yourself and your family.

Policy Terms and Conditions

Thoroughly review the policy documents to understand the terms and conditions. Pay attention to exclusions, waiting periods, and claim procedures. Clarify any doubts with the insurer before signing the policy.

Financial Stability of the Insurer

The insurer’s financial health is crucial for ensuring the long-term viability of your policy. Research the insurer’s solvency ratio and claims-paying ability. A financially stable insurer provides greater peace of mind.

Tax Benefits

Understanding the tax implications of your life insurance plan is essential. Policies generally offer tax benefits on premiums or the sum assured. Consult with a tax professional to optimize your savings.

Seeking Professional Advice

While it’s essential to do your research, consulting with a financial advisor can provide valuable insights. They can help you assess your needs, compare different plan features, and make informed decisions.

Remember, life insurance is a long-term commitment. Choosing the right plan requires careful consideration and planning. By understanding your needs and exploring available options, you can select a policy that provides adequate protection for your family’s financial future.

Find Your Perfect Term Insurance

Tata AIA offers top life insurance plans that cater to various needs and preferences, ensuring there’s a match for everyone. They are committed to providing comprehensive coverage, competitive pricing, robust claim settlement ratios, and exceptional customer service.

Looking for a top life insurance plan that ticks all the boxes? Visit Tata AIA’s website today!