Very few will be there who would be able to pay the whole cash and buy a property. The majority of people do not do that. Finding your desired property and then arranging the money for it can take a long time. So, we opt for mortgage loans. There are many kinds of mortgages available but you have to decide which would be the best for you. Let’s have a brief look at the options.

30 years fixed-rate home loan

It’s a home loan that has a fixed interest rate throughout the whole loan payment term. This is the most chosen home loan by property buyers. You get a long time to pay off the loan with low monthly payment rates and it stays the same till the end of the term. If you want you can even pay extra than the stipulated monthly installment to close the loan earlier. It offers this flexibility too.

15 years fixed-rate home loan

Just like the 30 year home loan plan, this loan repayment schedule spans 15 years. Here also the interest rate remains the same for the term of 15 years. The monthly payment is slightly higher than the 30-year term due to the shorter period. Home equity is built much faster because the loan owner will be paying more to the principal each month and less to the interest.

FHA home loan

This type of loan is insured by the Federal Housing Administration. FHA home loan has been introduced to help people of the moderate-income group in buying a property. They allow the borrowers to pay a very low down payment. The credit score a borrower needs to have is also significantly low. As per Metropolitan Mortgage Corporation, this loan is the most popular among first-time home buyers.

VA home loan

VA home loans are backed by the Department of Veteran Affairs. Military personnel and veterans are only eligible to apply for this loan. The interest rates are negotiable. There’s a very low down payment involved and in some cases, there is no down payment required also. No mortgage insurance is there for VA home loans.

USDA home loan

US Department of Agriculture issues this loan. These loans are for rural people belonging to the moderate or low-income group. Income eligibility, as well as property eligibility tools, are made available online by USDA to check the eligibility criteria. There’s no down payment required for USDA home loans.

Jumbo Home Loan

These loans are for expensive properties and require a larger down payment and a higher credit score. The minimum down payment accepted for jumbo loans is 20 percent of the property cost. They have flexible terms for repayment. No mortgage insurance is required.

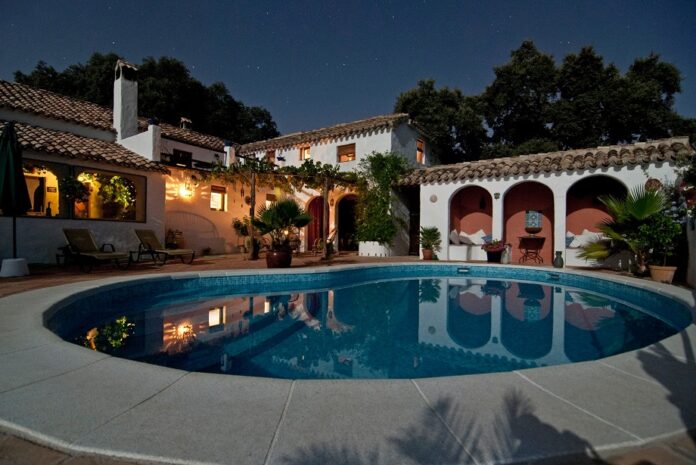

Vacation Home Loan

This loan is for a second-time property buyer. A vacation loan is chosen by people who are looking to buy a second property as an investment. A borrower gets to choose from the conventional or 30 years or 15 year home loan plans.

Conclusion

Before you decide which loan type to opt for, it would be good if you check your credit report to have a clear idea of your status. If you can get a preapproval letter beforehand, it becomes much easier to select the right property as the sellers are more likely to take you seriously.