Lending Club is a lending portal that provides its users with an online platform to borrow money from financial institutions. This lending community has been designed to make it easier for borrowers to find the right loan products that suit their requirements. A member of this lending community can access information about various loans such as personal, car, home and student loans. It also offers information about lending rates and other lending services available. The information provided by a lending club is unbiased and provided in order to assist borrowers in making the right lending decision.

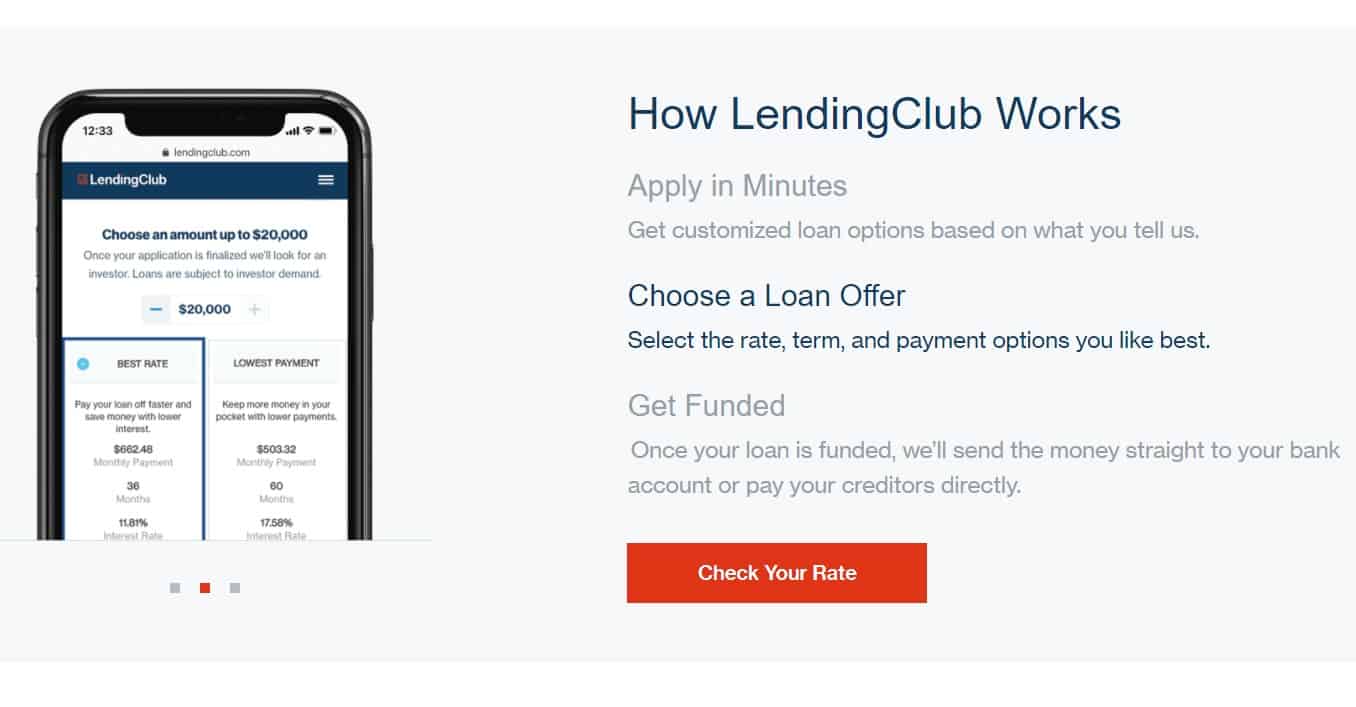

The website helps borrowers plan their finance through easy user-friendly navigation. You are able to select the type of personal loan that best suits your needs, with detailed loan specification information, interest rates and repayment options clearly outlined. You can calculate the amount you will be eligible to borrow by considering your monthly expenses, earnings, credit score, and current debt load. You can calculate the maximum loan amount by adding up your estimated expenditure, taking your annual salary and multiplying it by 3.

You can track your credit score and find out the areas in which you need improvement. You can also learn how to control your spending through the Home Affordable Program established by the federal government in cooperation with lending clubs to help borrowers reduce their debts. The Home Affordable Program helps borrowers who have adverse credit scores access affordable personal loans that require lower origination fees.

Lending Club allows members to share their experiences with different lenders. This sharing facilitates peer-to-peer lending by improving the quality of information about available loans. It is also used by investors to evaluate the lending programs of other investors and borrowers. Borrowers and investors can also apply for funding through the site without having to disclose their confidential information. Lending Clubs can be accessed by borrowers and investors through different lending clubs, which are independent organizations that offer similar loans to borrowers and investors.

The site facilitates borrower and investor education about credit scores, debt-to-income ratio, fair credit scores, FICO scores, bankruptcy history and other relevant information. It also provides useful information about how to access the multiple quotes function on its website. This functionality enables users to compare loan offers offered by different lenders. When comparing, the site notes down the differences between the original APR and the modified APR. The site also enables the users to submit a request for a quote via e-mail.

In August 2021, Lending Club launched a series of workshops for its members, titled “A Better Way: Creating Value and Profits for Real Estate Investors.” The workshops provided tips for managing lenders and borrowers, as well as managing risk. The seminars also presented case studies of real estate investments, which demonstrated how a company raised funds in a conventional manner and used lending techniques to create sustainable value for investors. One of the workshops discussed how to choose an angel investor.

The lending club uses online lending services to facilitate peer-to-peer lending. These services enable the users to access loans from a panel of lending companies that are members of the lending club. The loans are made directly through the company raised through a borrower’s credit card or bank account. In September 2021, Lending Club expanded its peer-to-peer lending services to include mortgage financing. This allows investors to access loans from a pool of real estate investors who have previously raised money through Lending Club. Another service added in August 2021 is the capability to borrow funds from accredited investors.

The lender’s lending criteria is based on income, credit history and borrowing capacity. Borrowers can expect to get fast approval for unsecured personal loans through Lending Club. The company does not require income verification or down payment. To date, the company has signed agreements with financing institutions in Canada and the United States, which allow it to process loan applications through their systems.