Customers using the Roisea trading platform can access various tools and information in the real world. Because the user interface of this platform can be easily modified, merchants can personalize their work environments so that they are specifically suited to the buying and selling processes and their needs.

Investors have access to various asset classes via the financial markets. The Foreign Exchange (Forex) and Stock markets are two asset classes among the most actively traded and profitable of these classes.

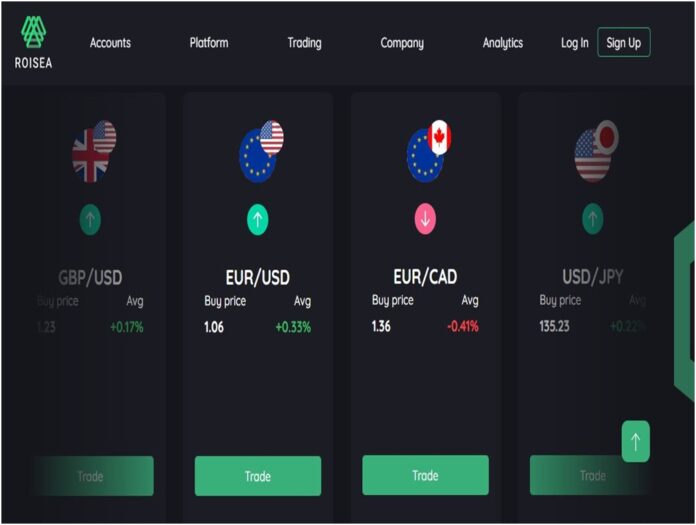

The market, more often described as the forex market, is where trading in currency pairings takes place using Roisea. The financial world’s market dominates in terms of size and liquidity. From selling, buying, and speculating of currencies are all legal activities that may take place on this market.

Additionally, it makes it possible to convert currencies to engage in international business and investing. The foreign exchange market is available for trading all day, every day of the week, and handles a very high number of transactions.

However, it is possible to think of the currency pair as a single unit when trading in Roisea, an instrument that can be purchased or sold. This is because all forex deals include the simultaneous purchase of one currency and the selling of another.

Forex brokers also have in buying currency pair, you sell the currency you want to acquire and buy the base currency. On the other hand, when you sell a currency pair, you will get the quoted currency in exchange for the base currency you sold.

When you trade currencies, you sell one currency to purchase another. On the other hand, when you trade commodities or stocks, you use cash to acquire a certain quantity of shares of a particular company or a single unit of the commodity you are selling.

Prices of trading pairs are impacted by economic indicators such as interest rates, economic growth, or gross domestic product (GDP), which are all related to the currency pairings being traded.

The following are a few arguments in favour of investing in various currencies with Roisea

Diversification

You may achieve portfolio balance via currencies, which is especially useful if your portfolio is substantially concentrated in shares traded in the United States. For instance, if you predict that the dollar’s value will decline in the future, you may invest your money in one or more currencies that you anticipate will increase in value with Roisea.

One distinction that can make between the movement of currencies and that of stocks is that currency movements are always relative to one another, but stock market movements are always independent of one another. When it comes to currencies, one must be declining in value for another to increase.

A Playing Field That Is Equal

In contrast to the stock market, the information influencing currency values is readily accessible to the general public in real-time. The foreign currency market open around the clock, which means that, in principle, there are no “insiders” in the market.

You can do your study on how these occurrences could damage a nation’s currency since the values of currencies determine by actual monetary flows and events that influence the economic health of a country.

Capital Appreciation

Since currencies, like commodities and equities, have the ability to increase in value, they are comparable investments. You will be in a better financial position if your currency’s value increases compared to the dollar. If the value of your coins decreases in comparison to the dollar, you will experience a financial loss.