Loan planning is an essential aspect of personal finance management, offering individuals a structured approach to borrowing money and managing debt responsibly. It involves a careful review of factors such as loan amount, interest rates, repayment terms, and overall financial goals. One valuable tool in this process is the personal loan EMI calculator, which provides users with instant calculations of their Equated Monthly Installments (EMIs).

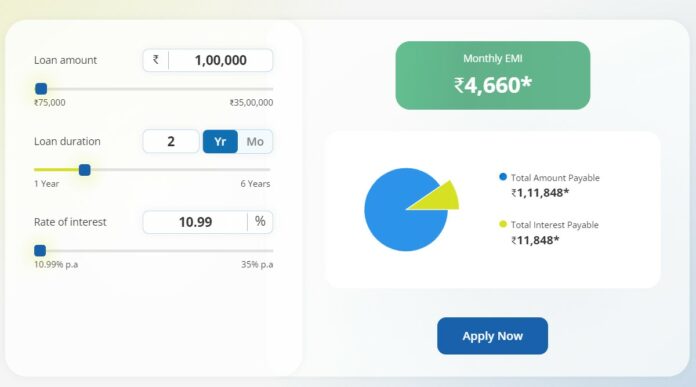

This tool allows borrowers to forecast their repayment obligations accurately, enabling better budgeting and financial decision-making. By entering variables like loan amount, interest rate, and tenure, individuals can gauge the affordability of a loan and tailor their borrowing strategies accordingly. Moreover, the personal loan EMI calculator empowers borrowers to compare different loan choices and select the most appropriate one based on their financial circumstances.

Therefore, it is very important to learn about the importance of using a personal loan EMI calculator, and tips to use this calculator effectively. Read on to know.

Reasons Why You Should Use a Personal Loan EMI Calculator

A personal loan EMI calculator is an indispensable tool that empowers borrowers with the necessary information. This helps in making the right financial decisions, ensuring responsible borrowing and effective management of personal finances. Using this calculator is important for several reasons:

- Budget Planning: It helps borrowers plan their budgets effectively by providing a clear understanding of the monthly outflow towards loan repayment. This allows individuals to assess their financial capability and make informed decisions.

- Accurate Repayment Estimation: The calculator provides accurate estimates of the monthly instalment amount, including both the principal and interest components. This helps borrowers anticipate their financial commitments accurately.

- Comparison of Loan Offers: By inputting different loan amounts, interest rates, and tenures into the calculator, borrowers can compare multiple loan offers from various lenders. This allows them to select the most appropriate option based on their financial situation.

- Adjustable Parameters: A good personal loan EMI calculator allows users to adjust parameters such as loan amount, interest rate, and tenure. This empowers borrowers to explore various repayment scenarios and choose the one that best fits their needs.

- Saves Time and Effort: Instead of manually computing EMI figures, which can be time-consuming and prone to errors, using a personal loan EMI calculator automates the process. This provides instant results, saving time and effort.

- Understanding Loan Affordability: By analysing the EMI amount to their income and expenses, borrowers can determine whether they can afford the loan without straining their finances excessively.

Tips for Using Personal Loan EMI Calculator Responsibly

Using a personal loan EMI calculator is the finest way to plan your finances responsibly. Here are some tips for using it effectively:

- Accurate Input: Ensure that you input accurate values for the loan amount, interest rate, and tenure. Even small discrepancies can lead to incorrect results.

- Consider Interest Rates: Understand that even a small change in the interest rate can greatly affect your EMI amount and total repayment. Consider different scenarios by adjusting the interest rate to see how it impacts your payments.

- Realistic Tenure: While opting for a longer tenure might reduce your EMI, it also means paying more interest over the loan term. Try to strike a balance between manageable EMIs and minimising the interest burden.

- Assess Your Repayment Capacity: Calculate your monthly budget to ensure you can comfortably afford the EMI without compromising your essential expenses or savings goals.

- Factor in Other Costs: Personal loans often come with additional charges like processing fees, prepayment penalties, etc. Factor these costs into your calculations to get a more precise idea of the total repayment amount.

- Prepayment Options: Check if the loan allows for prepayment without any penalties. Using the personal loan EMI calculator, assess how making extra payments or increasing your EMI affects the total interest payout and loan tenure.

- Plan for Contingencies: Consider unforeseen circumstances such as job loss or medical emergencies. Maintaining an emergency fund alongside your loan repayment can provide safety during tough times.

- Avoid Overborrowing: While it might be pleasing to borrow more than you need, it’s crucial to borrow only what you require. Assess your needs realistically and borrow accordingly to avoid unnecessary debt.

Empower Your Finances with EMI Loan Calculator

The use of a personal loan EMI calculator emerges as a game-changer, offering borrowers a streamlined approach to understanding their financial commitments. By simplifying loan planning, individuals gain better insights into their repayment schedules, helping them make informed decisions.

To reap the benefits, use a reliable tool like Tata Capital’s Personal Loan EMI Calculator. Empower yourself with accurate calculations and strategic planning to embark on a hassle-free journey towards achieving your financial goals. Calculate your EMI today and pave the way for a secure and well-managed financial future!